KM Component 24 – Knowledge Valuation Process and Intellectual Capital

Stan Garfield

A knowledge valuation process involves quantifying the value of knowledge assets, reuse, and innovation so they can be fully appreciated by the organization—embedded in customer pricing, cost benefit analysis, and project justification.

Assigning a value to your organization’s intellectual assets can help realize incremental revenue from sales to customers, support investments in knowledge creation and capture, and justify investments in your knowledge management program.

Explicitly defining the value of the reusable component of what you are selling to a customer allows you to use this value for competitive pricing, for additional profit margin, or to be set aside to fund additional knowledge creation and capture. To identify the value of reusable intellectual capital, ask the providing source for a suggested price, estimate the time and effort it would take to create from scratch, and then research the market value of the asset. Combine this information into an overall estimated value and use this to set the price. Whenever the price is higher than it would have been without adding the value of reuse, this incremental amount should be recorded and compiled as one source of the financial impact of the KM program.

Many organizations require cost benefit analysis before approving new investments and development projects. This is often true of the Information Technology function, which is faced with a multitude of requests for new systems or enhancements to existing systems. If investments involve intangible assets, it is difficult to use traditional methods to determine the projected return on investment. Using the techniques described by these thought leaders can help in providing the requested cost benefit analysis:

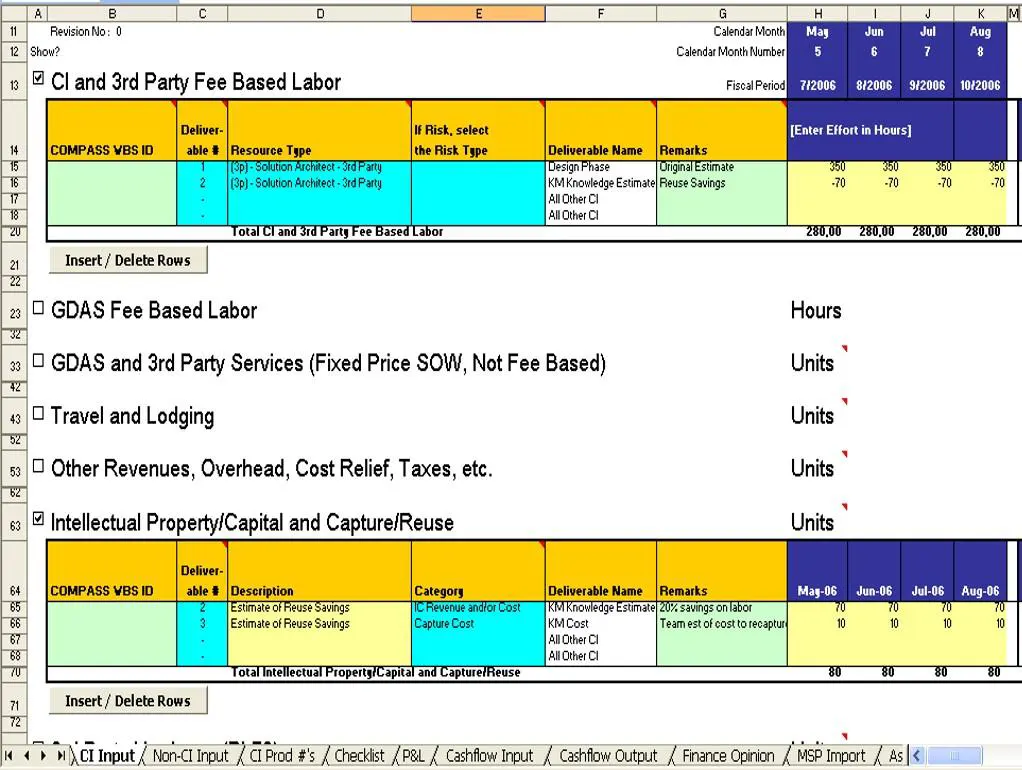

Here is an example of a valuation model that was developed at HP:

Intellectual Capital

Intellectual Capital is the sum of everything everybody in a company knows that gives it a competitive edge. A metric for the value of intellectual capital is the amount by which the enterprise value of a firm exceeds the value of its tangible (physical and financial) assets. Intellectual capital includes:

- Human capital, the value that the employees of a business provide through the application of skills, know-how and expertise, is an organization’s combined human capability for solving business problems and exploiting its intellectual property. Human capital is inherent in people and cannot be owned by an organization. Therefore, human capital can leave an organization when people leave, and if the management has failed to provide a setting where others can pick up their know-how. Human capital also encompasses how effectively an organization uses its people resources as measured by creativity and Innovation.

- Structural capital, the supportive non-physical infrastructure, processes and databases of the organization that enable human capital to function, includes processes, patents, and trademarks, as well as the organization’s image, organization, information system, and proprietary software and databases. Because of its diverse components, structural capital can be classified further into organization, process and innovation capital. Organizational capital includes the organization philosophy and systems for leveraging the organization’s capability. Process capital includes the techniques, procedures, and programs that implement and enhance the delivery of goods and services. Innovation capital includes intellectual property such as patents, trademarks and copyrights, and intangible assets. Intellectual properties are protected commercial rights such as patents, trade secrets, copyrights and trademarks. Intangible assets are all of the other talents and theory by which an organization is run.

- Relational capital consists of such elements as customer relationships, supplier relationships, trademarks and trade names (which have value only by virtue of customer relationships), licenses, and franchises. The notion that customer capital is separate from human and structural capital indicates its central importance to an organization’s worth. The value of the relationships a business maintains with its customers and suppliers is also referred as goodwill, but often poorly booked in corporate accounts, because of accounting rules.

Stan Garfield

Please enjoy Stan’s additional blog posts offering advice and insights drawn from many years as a KM practitioner. You may also want to download a copy of his book, Proven Practices for Implementing a Knowledge Management Program, from Lucidea Press. And learn about Lucidea’s Inmagic Presto and SydneyEnterprise with KM capabilities to support successful knowledge curation and sharing.

Similar Posts

Only You Can Prevent Knowledge Loss: How to Practice “Knowledge Archaeology”

An overview of ways in which knowledge is lost, with examples of how to perform knowledge archaeology to recover and restore it.

Ready to Read: Profiles in Knowledge: 120 Thought Leaders in Knowledge Management

We are pleased to announce that Stan Garfield’s new book, Profiles in Knowledge: 120 Thought Leaders in Knowledge Management, is now available from Lucidea Press.

Lucidea’s Lens: Knowledge Management Thought Leaders Part 92 – Jay Liebowitz

Jay Liebowitz is a professor, consultant, author, and editor. His research interests include knowledge management, data analytics, intelligent systems, intuition-based decision making, IT management, expert systems, and artificial intelligence.

Lucidea’s Lens: Knowledge Management Thought Leaders Part 91 – Frank Leistner

The late Frank Leistner was the former Chief Knowledge Officer for SAS Global Professional Services, where he founded the knowledge management program and led a wide range of knowledge management initiatives up until 2012.

Leave a Comment

Comments are reviewed and must adhere to our comments policy.

0 Comments